By Ryan Mitchell | Updated: Nov 29, 2025

- Update Log: Added 2025 analysis of exchange solvency risks & new hybrid custody strategies.

Editor’s Note:

“I’ve audited hundreds of wallets, and the single biggest mistake I see isn’t technical—it’s philosophical. People treat crypto like a bank account, trusting third parties with their life savings. Then the exchange freezes withdrawals, and it’s too late. This guide is your roadmap to taking back control.”

— Ryan Mitchell, Technical Lead at BeginnerWallets

“Not your keys, not your coins.”

If you are new to crypto, this phrase might sound like a catchy slogan. But for anyone who lost funds in the FTX collapse, it is a painful reality.

The most critical decision you will make isn’t which crypto asset to buy—it’s where you store it. The debate between using a custodial wallet versus a non-custodial wallet is about more than just convenience; it is about who truly owns your money.

In this guide, we will break down the difference between custodial and non-custodial wallet options, explain why your private key matters more than you think, and help you decide which wallet provider fits your risk tolerance.

At a Glance: Who Holds the Keys?

Before we dive deep, here is the core difference:

- Custodial Wallet: Like a bank. A third party holds the keys. If they shut down, you lose access.

- Non-Custodial Wallet: Like a personal safe. You hold the keys. If you lose them, no one can help you.

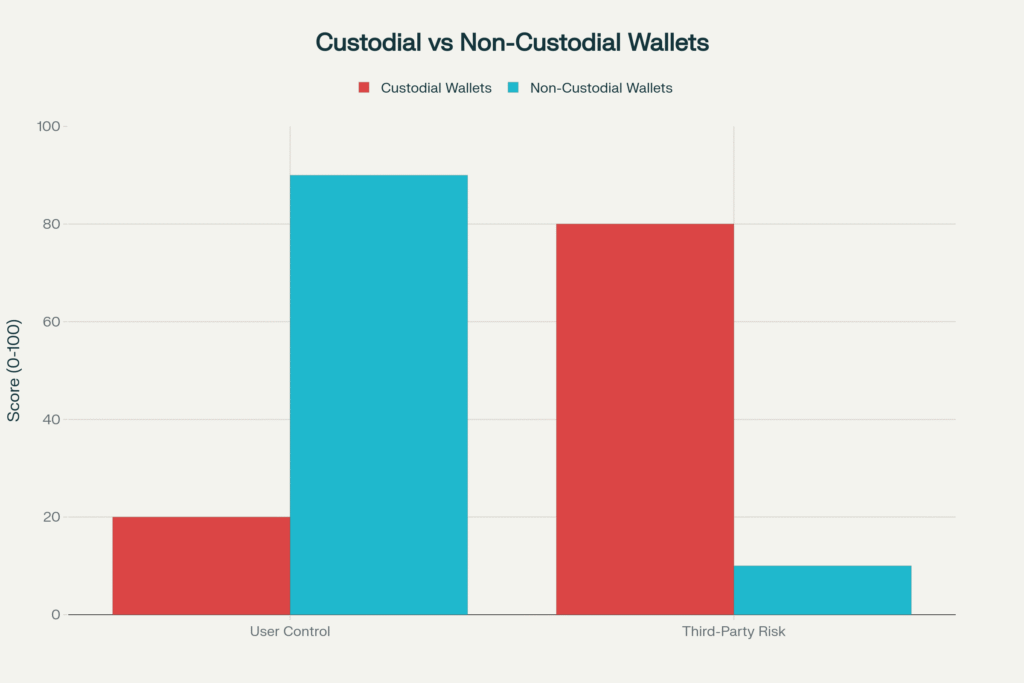

As shown in the chart above, custodial wallets force you to trade control for convenience, creating a higher third-party risk profile compared to non-custodial options.

The Core Concept: The Private Key

To understand wallets, you must understand the private key. A crypto wallet doesn’t store coins; it manages these keys.

- A private key is a cryptographic password that proves ownership of a digital asset on the blockchain.

- Whoever holds the private key has full control over the funds.

This is where the split happens. Custodial and non-custodial services differ entirely on who gets to hold this all-important key.

Custodial Wallets: The “Bank Account” Model

A custodial wallet is a service where a business (like a crypto exchange) manages your wallet for you. When you create an account on Coinbase or Binance, you are using a custodial wallet.

How It Works

You log in with a username and password. The wallet provider holds the private key on their servers. You do not own the address on the blockchain directly; the exchange holds the crypto on your behalf, much like a bank holds your cash.

Pros

- Forgiving: If you forget your password, you can reset it. You won’t lose access to your funds permanently due to a memory slip.

- Convenience: These wallets include easy fiat on-ramps, making it simple to buy crypto with a credit card.

- Low Fees: Transfers within the same custodial wallet ecosystem are often free and instant.

Cons

- Third-Party Risk: You are trusting third parties not to get hacked, go bankrupt, or freeze your account.

- Lack of Ownership: You do not have the private key. Technically, the crypto exchange owns the assets and owes you an IOU.

Non-Custodial Wallets: The “Personal Safe” Model

A non-custodial wallet (also called a self-custody wallet) gives you full control. You are the only person on earth with the private key.

How It Works

When you set up a non-custodial crypto wallet like MetaMask, Trust Wallet, or a Ledger device, you are given a “Recovery Phrase” (12-24 words). This phrase is the master key to your private key.

Pros

- True Ownership: No one can freeze your funds. You have absolute sovereignty over your crypto assets.

- Privacy: Non-custodial wallets typically don’t require KYC (identity verification). You can create a wallet in seconds without sharing your ID.

- DApp Access: Wallets allow you to connect directly to DeFi platforms and NFT marketplaces.

Cons

- Zero Safety Net: If you lose your recovery phrase, you lose access to your money forever. There is no “Forgot Password” button.

- Responsibility: You are responsible for your own security. If you click a malicious link, your wallet can be drained.

Comparison: Custodial vs. Non-Custodial Wallet

| Feature | Custodial Wallet | Non-Custodial Wallet |

|---|---|---|

| Key Holder | Third parties (Exchange) | You (The User) |

| Control | Limited (Can be frozen) | Full control |

| Security Risk | Exchange Hack / Bankruptcy | User Error / Phishing |

| Recovery | Possible via Customer Support | Impossible if seed phrase is lost |

| Best For | Trading & Beginners | HODLing & Security |

| Examples | Binance, Coinbase | MetaMask, Trust Wallet, Ledger |

Security Deep Dive: Why “Not Your Keys” Matters

History is littered with custodial wallet failures. From Mt. Gox to FTX, billions of dollars in crypto have vanished because users trusted the wrong third parties.

In contrast, a non-custodial wallet is immune to exchange bankruptcy. Even if the wallet provider (like Ledger or Trezor) goes out of business, your funds are safe because your private key lives on the blockchain, not their servers. You can simply restore your private key into a different compatible wallet software.

However, non-custodial wallets introduce personal risk. Wallets require you to secure your seed phrase offline. If you store it on a cloud drive and get hacked, your digital asset portfolio is gone.

The Hybrid Approach: The Expert Strategy

You don’t have to choose just one. Most experienced crypto users use both custodial and non-custodial wallet solutions together.

- On-Ramp (Custodial): Use a crypto exchange to buy your coins with fiat currency.

- Storage (Non-Custodial): Immediately withdraw your crypto to a hardware wallet like a Ledger.

This strategy leverages the convenience of custodial wallets for buying while ensuring the long-term safety of a non-custodial wallet for holding.

FAQ: Making the Switch

Can I switch from custodial to non-custodial?

Yes. You simply create a new non-custodial crypto wallet and withdraw your funds from the exchange to your new address.

Which wallet is safer?

A hardware wallet (a type of non-custodial wallet) is the gold standard. It keeps your private key offline, protecting it from online hacks that might affect a hot wallet like MetaMask.

What if I lose my non-custodial wallet device?

As long as you have your recovery phrase, you can buy a new device and restore your private key. You only lose access if you lose that phrase.

Do non-custodial wallets have higher fees?

Not necessarily. While custodial wallets often offer free internal transfers, non-custodial wallets require you to pay network (“gas”) fees directly to the blockchain miners. You have full control to set these fees, but they can be expensive during busy times.

Which Should You Choose?

- Choose a Custodial Wallet If: You are a complete beginner, trade frequently, or are terrified of managing your own passwords. Wallet offers from major exchanges provide a decent safety net for small amounts.

- Choose a Non-Custodial Wallet If: You hold a significant amount of crypto, value privacy, or want to use DeFi apps. Taking control of a non-custodial wallet may seem intimidating at first, but these wallets give you the true financial freedom that crypto was built for.

Ultimately, the goal of cryptocurrency is self-sovereignty. While a custodial wallet is a fine starting point, graduating to a non-custodial wallet is the only way to truly own your wealth.

About the Author

Ryan Mitchell is the Technical Lead at BeginnerWallets. With a background in FinTech cybersecurity, he specializes in auditing hardware wallet architecture and recovery protocols. He is known for his skeptical approach, rigorously testing manufacturer claims to ensure they meet the highest security standards.